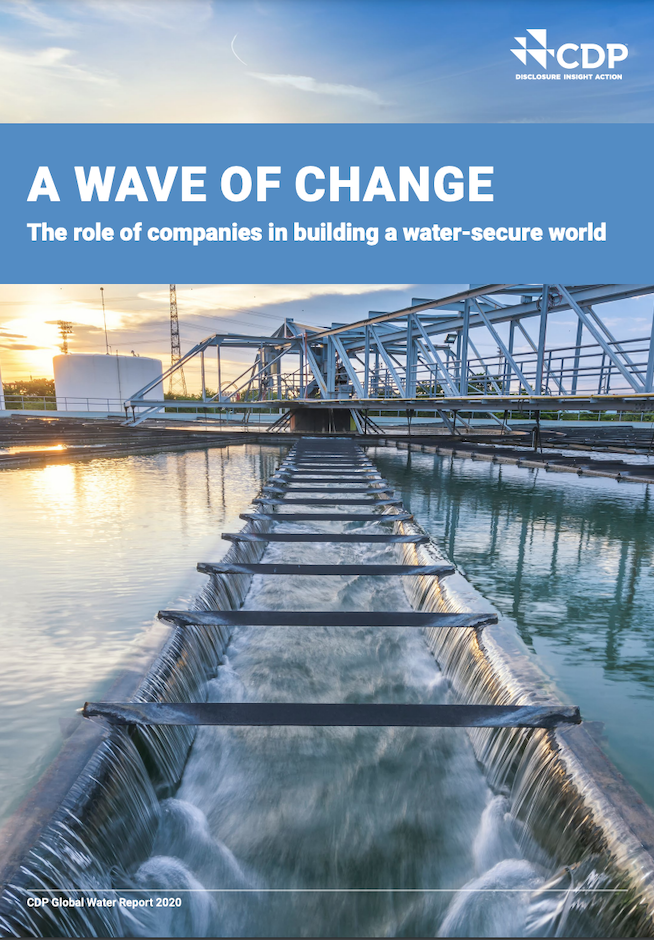

Anyone wanting to make a profit building treatment plants faces three challenges.

The first is that construction is the lion’s share of the cost of projects, and getting it

wrong negates all the rest of the work. The second is that much of the rest of the

work involves buying in other people’s equipment, which makes it difficult to

deliver a competitive advantage. The third is the lumpiness of the revenues in the

market.

Different companies have different approaches to addressing these problems. The

US engineers are largely stepping back from design-build work, and are pushing

instead for hybrid procurement models that maximize fees while minimizing

competitive pressures. Suez WTS has backed out of EPC contracting altogether.

Instead it focuses on proprietary system sales. This works in the industrial market,

but historically in the municipal market, proprietary technologies play a smaller

role. Veolia is bidding to change that. It wants to maximize the use of preengineered,

digitally enabled proprietary systems in municipal treatment plants.

This, it hopes, will reduce construction complexity, give a lasting competitive

advantage, and provide ongoing digital revenues.

It is a nice strategy, but it depends on clients continuing to trust their contractors

with design work. There is a risk that, as construction companies replace water

treatment specialists in EPC contracts, clients will feel the need to rely on their own

engineers to draw up detailed designs. This would leave less room for Veolia’s

innovations.